Recent Blog Posts

Retirement Planning Solutions

Champaign, IL

Fully Licensed

Free Consultations

More Than 25 Years of Experience

Hours:

Request Lorem Epsom

Hero Request Form

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later.

Secure Your Future with Expert Retirement Planning

At Advanced Financial Freedom, we recognize the importance of retirement planning in securing your financial future. Our team of financial planners in Central Illinois and surrounding areas is dedicated to helping you achieve your retirement goals. We provide personalized retirement planning services that cater to your specific needs and circumstances. Our retirement planning services include:

- Custom retirement strategies

- Investment portfolio oversight

- Social Security planning

- 401(k) and IRA advice

- Pension plan review

- Long-term care preparation

- Estate planning guidance

- Tax-efficient withdrawal plans

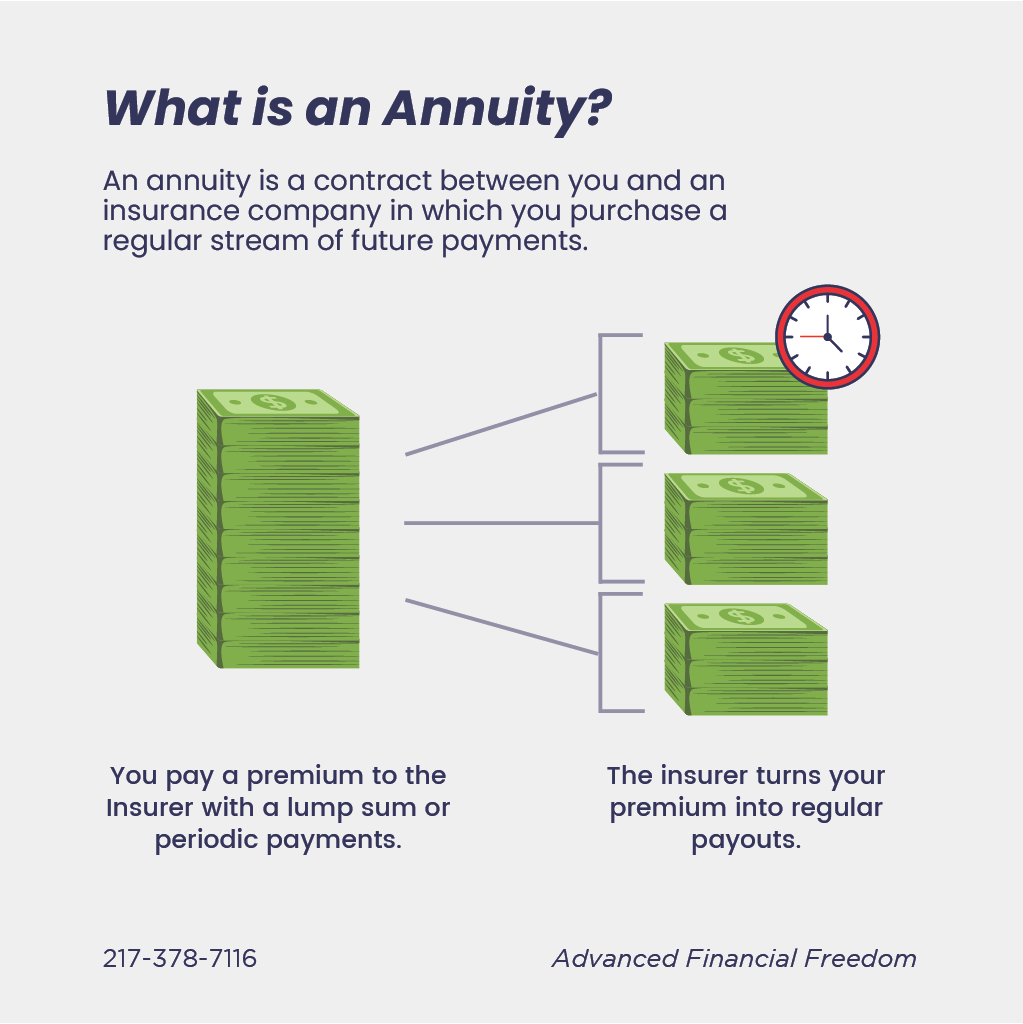

- Annuity options

Ensure your retirement is well-planned.

Contact us today to start building a secure financial future.

Key Risks Retirees Face

- Outliving Your Money – Many retirees underestimate how much they need; over half feel their savings won’t last a lifetime.

- Market Risk – Investment losses near or after retirement can reduce savings and limit recovery time.

- Health Care Costs – Significant medical expenses can exceed retirement funds without proper planning.

- Rising Cost of Living – Inflation increases everyday expenses, impacting retirement budgets.

- Social Security Gaps – Benefits may not cover basic living costs, requiring additional income planning.

Why You Need Professional Retirement Planning

Retirement planning is an ongoing process that requires expertise and careful thought. Here's why partnering with Advanced Financial Freedom for your retirement planning is crucial:

- Boost retirement savings potential

- Understand tax implications

- Ensure proper asset distribution

- Adjust to market changes

- Plan for inflation and longevity

- Align retirement with overall financial goals

- Develop Social Security claiming strategies

- Create a sustainable withdrawal plan

Contact Us

Your path to a secure retirement begins with a conversation. At Advanced Financial Freedom, we're here to understand your concerns, learn about your goals, and create a custom retirement plan that fits your vision. Our experienced financial planners will guide you through the retirement planning process, ensuring you have the knowledge to make informed decisions. Start securing your financial future today.

Contact us to schedule your free consultation and take the first step towards a confident retirement.

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Gallery Heading H2

Reviews

Retire Debt Free